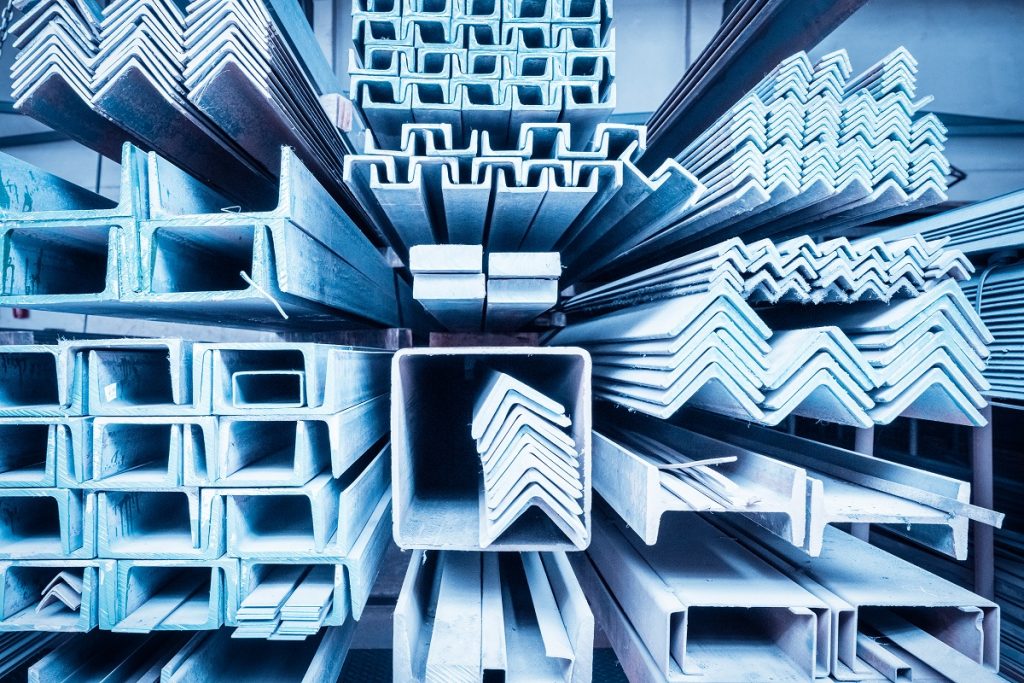

Many construction companies recognize China as a production superpower. China is more or less responsible for fulfilling the world’s demand for construction materials by manufacturing building materials such as kitchen cabinets, lighting, ceilings, doors, windows, bathroom fixtures, marble, ceramic tiles, etc. In the following guide, we will discuss the rules and regulations for importing construction material from China to Canada by your business account.

- Get a Business Number

Getting a BN (Business Number) to open an import/export account is one of the most important steps in importing construction material from China to Canada. To obtain a Business Number, all you need to do is contact the Canada Revenue Agency (CRA) or visit their website and apply for it. - Classify Imports from China to Canada

In order to classify the construction material that you are importing, CBSA uses a Harmonised System of Classification. The purpose of the system is to provide you with a unique ten-digit code. Take note that the first six figures of the generated HS number will be universal, which means they will be the same for Canada and China. However, the last four digits will present a unique code that will be used by the CBSA for statistical purposes and to establish duty rates. - Understanding Canadian Import Rules (Tariff and Duty)

Do you know the correct tariff classification number? If not, you must find the appropriate tariff classification number to determine the taxes on the types of construction material you are importing. You must also have proof of the origin of the imports to form an authentic Tariff Agreement. Moreover, in correspondence to the value of goods you are importing, you must also determine if your goods are subject to excise duty, sales tax, excise tax, and/or provincial sales tax. - Apply for Relevant Certificates, Permits, and Inspection

It is your responsibility to let the Canadian authorities know about your shipment before importing construction material from China to Canada. To do this, you will need to contact the relevant agency to inform them about your importing plans and provide them with details of the construction material. The authorities will then cross-check the type of your goods in their database to see if they are permitted to be imported. Read the CBSA’s Prohibited Importations document to check if the construction material you are importing is allowed. Also, while doing so, apply for the inspection check and relevant certificates. - Shipping and Reporting Construction Material

The sources of transportation that you can use to ship construction material into Canada include courier service, air freight, highway, rail, or marine. Because construction materials are categorised as commercial goods, it is your job to report your shipment to the CBSA. At this point, there is a possible chance that either the CBSA officers or the government officials might examine your shipment. - Filing for the Release of Construction Material

There are two methods to get your shipment released:

● Release the shipment before the payment of taxes and duty: Fill in the application for the RMD (Release on Minimum Documentation).

● Make payment after the release of the shipment: Keep a record of all the accounting documents and payments at the time of release.

The Verdict

Whether you have just started importing or are already aware of its ins and outs, you must get your facts straight before importing construction material from China to Canada. You will need to follow all the rules and regulations and keep the records safe for future inquiry by the CBSA. If you require assistance with this process, hire ARGO Customs Brokers today!